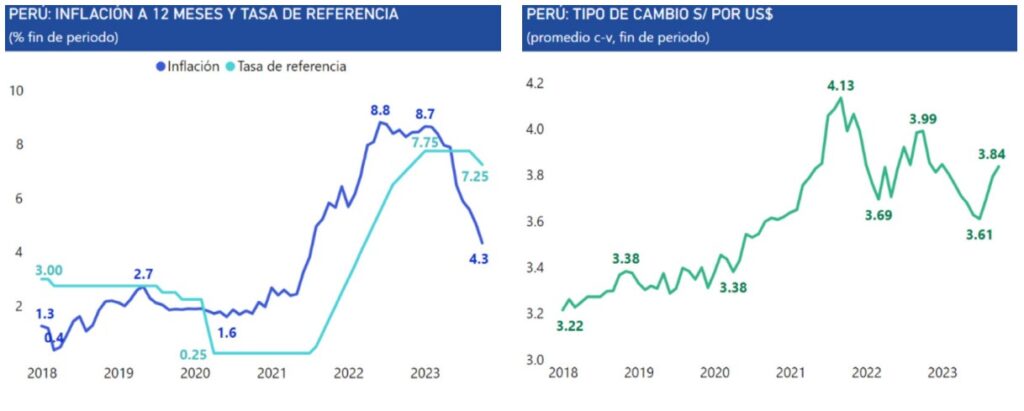

While inflation has receded (from 8.7% to 4.3% in October) and an initial reduction in the BCRP reference rate is observed, indicators still remain well above their pre-pandemic levels. In addition, there is an erratic exchange rate, sensitive to political events and international developments such as announcements from the U.S. Federal Reserve (FED).

Macroeconomic environmen

Note: Information as of October 2023. Source: BCRP.

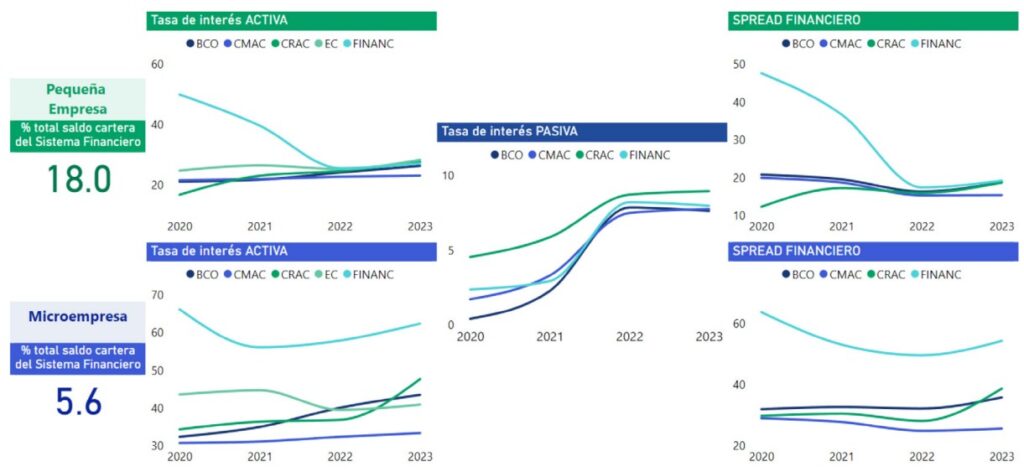

In this environment, financial institutions focusing on SMEs have been adjusting both their active and passive interest rates, with a clear convergence (regardless of the type of financial institution) in active rates for the Small Business segment. This result indicates a high level of competition. Results differ in the Microbusiness segment, where interest rates are comparatively higher. Notably, Municipal Savings and Credit Unions (CMAC) offer the lowest active rates, while Financial Institutions report the highest.

The passive rate showed a consistent upward trend, in line with the reference rate, reflecting the competition to attract more funding, with Rural Savings and Credit Unions (CRAC) offering the highest passive rate. As a result, the financial spread (calculated as the average difference between active and passive rates) shows a marginal improvement in the small business segment and a broader one for the microbusiness segment, due to a higher risk profile and operating costs.

Financial intermediation behavior towards SMEs.

Note: Multiple Banking (BCO) only considers Mibanco. The loan portfolio balance includes the business segment. The passive interest rate corresponds to annual time deposits. The financial spread is the benchmark difference between the active and passive interest rates. The interest rate corresponds to the end of the annual period except for 2023 (cut-off in September). Source: SBS.

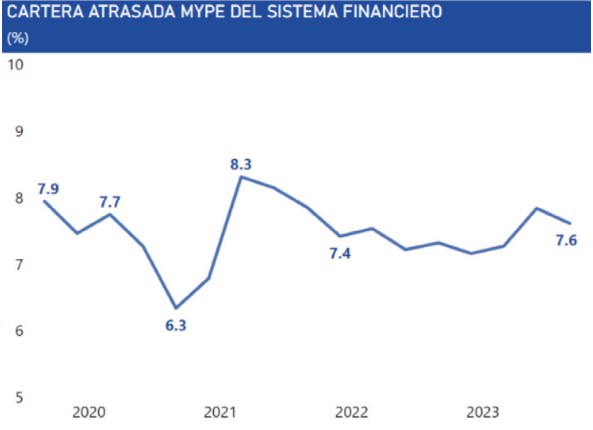

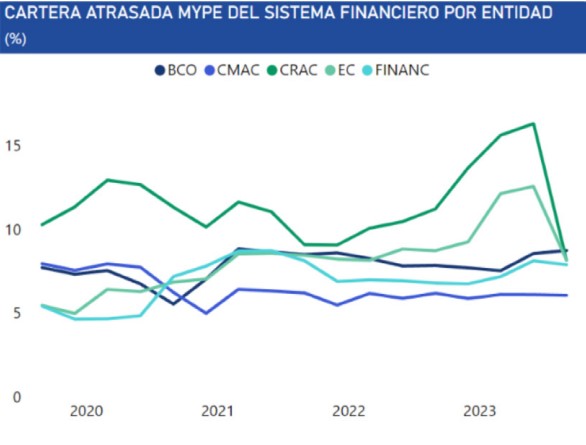

Despite the challenging context, the overdue SME portfolio has remained resilient and stable in the last two years. However, when analyzing the ratio by type of institution, both Rural Savings and Credit Unions (Cajas Rurales) and Credit Companies (Empresas de Crédito) showed an increase in this indicator in the last year, presumably mitigated by the departure of CRAC Raíz and EC Acceso from the system. On the contrary, Municipal Savings and Credit Unions (Cajas Municipales) show the lowest indicator.

SME - Performance of the overdue portfolio

Note: Information as of September 2023, on a quarterly basis. According to the SBS, the overdue portfolio refers to ‘direct loans that have not been canceled or amortized on the due date and are in a situation of overdue or in judicial collection.’ Source: SBS.

Note: Information as of September 2023, on a quarterly basis. Source: SBS.

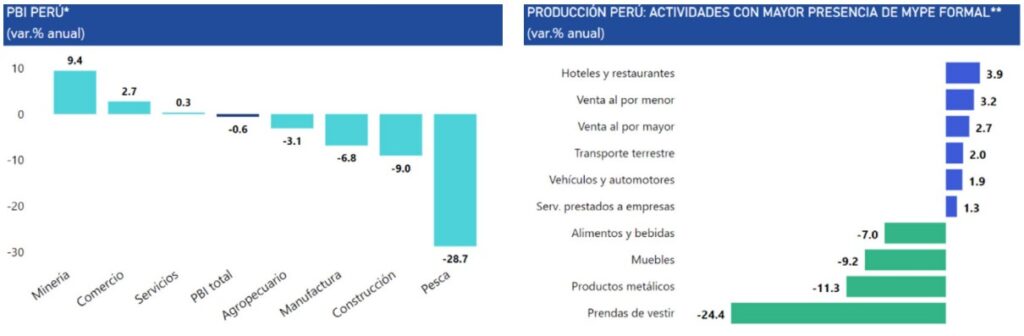

Undoubtedly, the decline in Peru’s GDP, affected by reduced global economic activity as well as the socio-political challenges in the country, is accentuated between January and August 2023, with an indicator in negative territory (-0.6% annually). The downturn in the Construction and Manufacturing sectors, along with weak growth in Services, explains this. This situation is reflected in activities where formal SMEs have a significant presence, highlighting a concerning contraction in the manufacturing industry of clothing, metal products, and furniture.

PERU and SMEs - GDP Production

*/ GDP does not consider import duties and other taxes. Data as of August 2023. /** Activities selected were based on the annual report ‘Micro and Small Enterprises in Figures’ – Produce (2018-2021). Note: Mining includes the Hydrocarbons sector. Source: INEI, BCRP, and Produce.

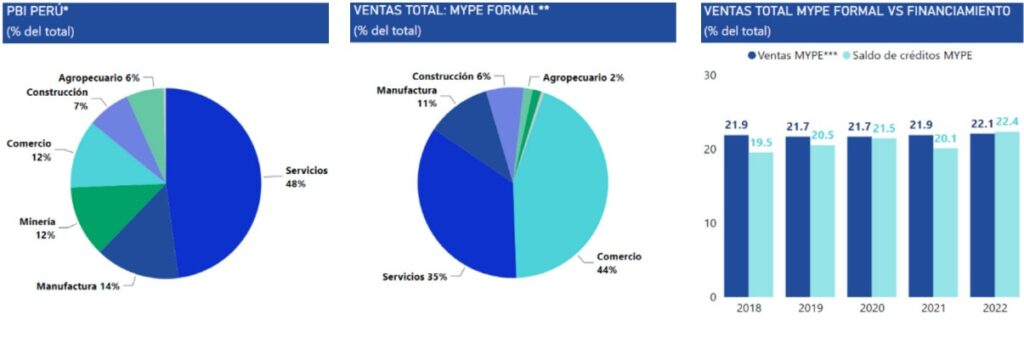

Regarding the sectoral composition in which SMEs are concentrated, Commerce takes the lead (44% of the total), followed by Services and Manufacturing. At the national level in Peru, Services lead the way (nearly 50% of the total), followed by Manufacturing and Mining. It is noteworthy that both the contribution of formal SMEs to the total annual sales and the loans they receive from the Financial System align at around 20%.

Peru and Formal SMEs - GDP and Sectoral Composition

*/ GDP does not consider import duties and other taxes. **/ It includes the sale of medium-sized enterprises, which represents 9% of SMEs and 2% of the total, respectively. ***/ Sales data for 2022 were estimated based on the annual report ‘Micro and Small Enterprises in Figures’ prepared by the Ministry of Production-PRODUCE (2018-2021). Note: The credit balance refers to the business segment. Mining includes the Hydrocarbons sector. Peru’s GDP data corresponds to 2022, and formal SME data is from 2021 (last available). Source: Produce, SBS, and BCRP.

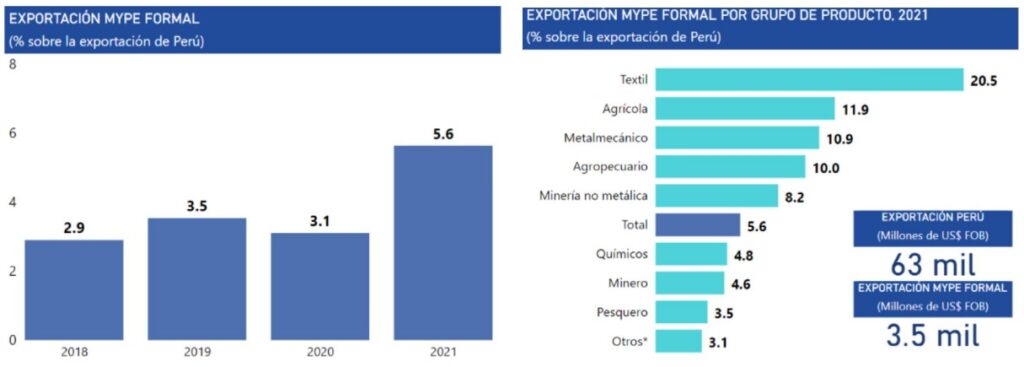

In the realm of exports, it is noteworthy that formal SMEs progressively increase their contribution to the country’s total exports (2.9% in 2018 versus 6% in 2021, according to the latest available information). By product subgroup, SMEs play a significant role in textile, agricultural, livestock, and metal-mechanical products.

Contribution of formal SMEs to the total exports

*/ Others include oil and derivatives, iron and steel products, and others. Note: Information is as of 2021, the last available data for formal SMEs. Source: PRODUCE and BCRP.